(See which brands Superunion picked in a story we published yesterday)

Until recently, home served as a basecamp for many working professionals, a functional space to sleep. Exercise, enjoyment, eating and employment were outsourced to individual ‘centres of excellence’—great restaurants, vibey bars, expensive gyms and workplaces designed to feel a bit like a home.

Yet all that is now happening under one roof: we are organising the space around us differently, adjusting its purpose. Even as normality returns, the way we view our home space will be forever changed. And as we scramble to adapt, brands are following furiously, knowing agile first-movers have a distinct advantage.

Living space

When our living space is confined almost entirely to our homes, making the best use of it takes on new meaning. For some, it’s about furnishing that empty corner or finally tackling half-finished DIY. For others, it’s about carving out new spaces to work, play or learn. Previously forgivable compromises now become a priority, and the clear winner here is home furnishings market leader Ikea, top-of-mind for moments of transition.

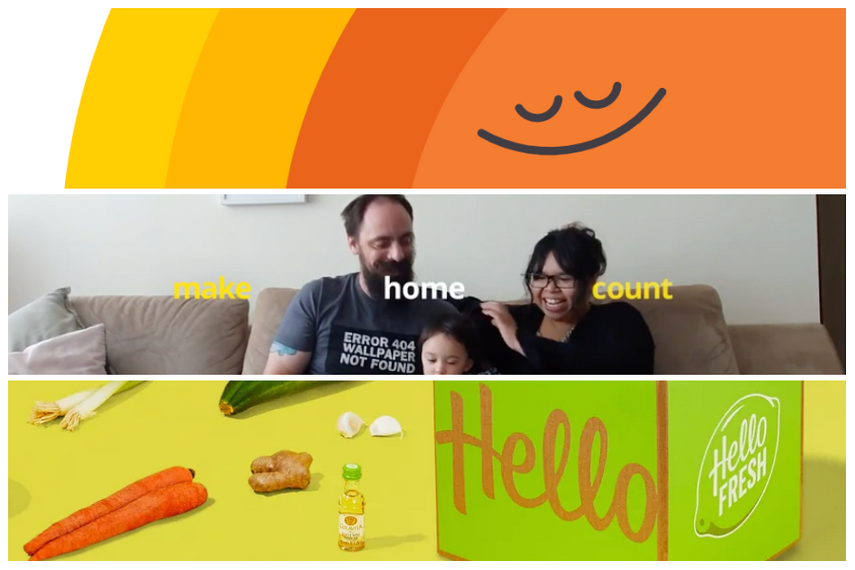

Ikea’s latest Singapore campaign addresses why now more than ever, our living space should feel comfortable, functional and inviting. It doesn’t matter whether we live in a multigenerational household or we live on our own, the film’s raw home footage reminds us that now is the time to make every moment count. And that starts by making the best of the space we have.

Head space

When socialising, exercise and going out have worked for years as our safety valves, will a significant reduction of these leave us no other option but to ‘go in’, and ask ourselves how we are feeling? Many brands are offering free resources to help people with this: Blinkist, which offers short summaries of non-fiction books, has upgraded free subscriber accounts to premium for the next month, whilst Headspace is offering bonus content tailored to the current situation. It takes 21 days to form a habit, and these companies are no doubt banking on recruiting new users who will stick with them once they’ve weathered the storm. The question will be how to help people maintain momentum once we return to a new normal.

Entertainment space

With people looking to use their time inside purposefully, cultural institutions from London’s National Theatre to the Rijksmuseum in Amsterdam and the Frida Kahlo Museum in Mexico have also stepped up, bringing virtual shows and tours to everyone. Whilst this certainly avoids the crowds, can it replace the thrill of the real thing? To sustain popularity long-term, the way forward for these organisations may be to tap into their knowledge database in order to add value by digitizing audio guides or running live Q&A sessions.

In the entertainment space, live sports are certainly the toughest act to follow, but esports are closing the gap and keeping fans engaged. In racing, F1 and Nascar have already announced intentions to launch a sim racing series, and the UK’s virtual Grand National enjoyed a viewership of 4.8 million, with 2.6 million GBP raised for the National Health Service. Esports will allow organisations to fulfil sponsorship obligations and marketing commitments, whilst opening up opportunities for continued collaboration. More than a stopgap, the winners in esports will be those who unlock the suspense and hype associated with physical sport.

Dining space

Food delivery apps enjoyed booming business at the beginning, but as people find their free time increasing, a convenience-led delivery service of ready-made food risks missing the point. Fodder for time-starved young professionals heading home on their way back from the gym, home deliveries offer little satisfaction now people are rediscovering the joy of cooking.

Yet people will need help to maintain this new habit once normal schedules resume, and that’s where meal-kit brands could experience more sustained growth. Popular in the West for speeding up the process without taking the credit, companies such as Germany’s Hello Fresh have seen a substantial increase in shares this month. Yet in Asia, where speed and convenience of food delivery is king, no meal kit company has yet had success. This leaves the way clear for restaurants to offer make-at-home dishes, especially important if their menu items don’t deliver well ready-made.

In this phase of transition, we will be more open than ever to trying new things, adjusting to new norms and finding new ways to keep ourselves happy and healthy. Some brands stand to win big short-term if they cater to these new sentiments and behaviours. But the (perhaps more surprising) brands who will win big long-term are those poised to adapt and re-adapt once we transition into life on the other side.

Branding agency Landor has Asian offices in Bangkok, Beijing, Guangzhou, Hong Kong, Jakarta, Melbourne, Mumbai, Seoul, Shanghai, Singapore, Sydney & Tokyo.

.jpg&h=334&w=500&q=100&v=20170226&c=1)

.jpg&h=334&w=500&q=100&v=20170226&c=1)

.jpg&h=334&w=500&q=100&v=20170226&c=1)

.jpg&h=334&w=500&q=100&v=20170226&c=1)

.jpg&h=268&w=401&q=100&v=20170226&c=1)